A little over a year ago, we were raising the topic of online client identification. Today we are going to further discuss problems and present you our new technological solution, developed over the past time.

Within the last five years, the identification of client’s personality has become not only a mandatory regulatory requirement for financial organizations but also a sales driver and risk reduction tool. Compiling a real portrait and getting the right definition of a client (along with his or her needs, character and behavioural characteristics) is a golden ticket that allows offering the client what he or she needs, and receiving loyalty, maximising profits and minimising risks in return.

Is not it a dream for any bank, microlender or insurance company? But the reality turns a relatively simple and unambiguous tool into a real challenge for both online and offline channels.

Many financial operations, such as loan issuing via both offline and online, require client identification. Client ID (and a number of other documents) is usually enough for identification. Bank or microlender office employees and consultants pick up an ID, check it, compare it with an opposite sitting customer (as a reference) and complete the first stage of identification, together with a whole set of client data collected and recorded. This how it works for the offline channel.

Online is also complicated by the fact that there is no “reference” sitting opposite (as a matter of fact there is no idea of who “is opposite” to you behind the screen) and there is a digital copy instead of real ID. Then for a better “acquaintance” organizations start to collect countless personal and behavioral data, alongside with biometrics (face image and voice recording).

And that’s where the problems begin.

Picture 1: Black Sails, s1e2, 2014.- source: Youtube, channel theISDD

Admittedly any additional action or question to a “good” and trustworthy client may lead to client’s refusal from the service. A good borrower is not at all inclined to leave too much data about himself or herself, especially when it comes to the image (especially in the online).

Then it is necessary to consider that such data bear a significant risk for the credit organization. After all, without certainty in the ID based identification (and even worse – in fraud cases), further data collection can “paint” a portrait of a completely different client. Such seemingly unique and inalienable data can still be stolen or obtained by fraudsters. As a result both the organization and the clients (especially the real owner of the stolen portrait) will suffer.

Finally, even if we exclude the negative side, many of these data are not and may not be referent and stable in time.

On the other hand, there are developers of biometric solutions competing in comparing ID and real “portraits”. But the appearance of a person can change gradually (aging) or quite dramatically (style changes). A photo in ID changes with the document only twice (according to the law) and is not able to keep up with appearance changes. As a result, both appearance and ID can not be a stable in time reference. Slight difference between them leads to errors of the second type (incorrect or imprecise definition of the client, for example, below 95% caused by a new wrinkle or scar on the face), and a “good” client is declined for a new loan or insurance.

To change the situation additional information may be collected, but then again the dislike for additional questioning from the “good” borrowers and, as a consequence, the lost deal again.

Moreover, the fact of data storage by such suppliers bares a huge risk for the clients whose data may be compromised as well as requires precise meet of legislation requirements.

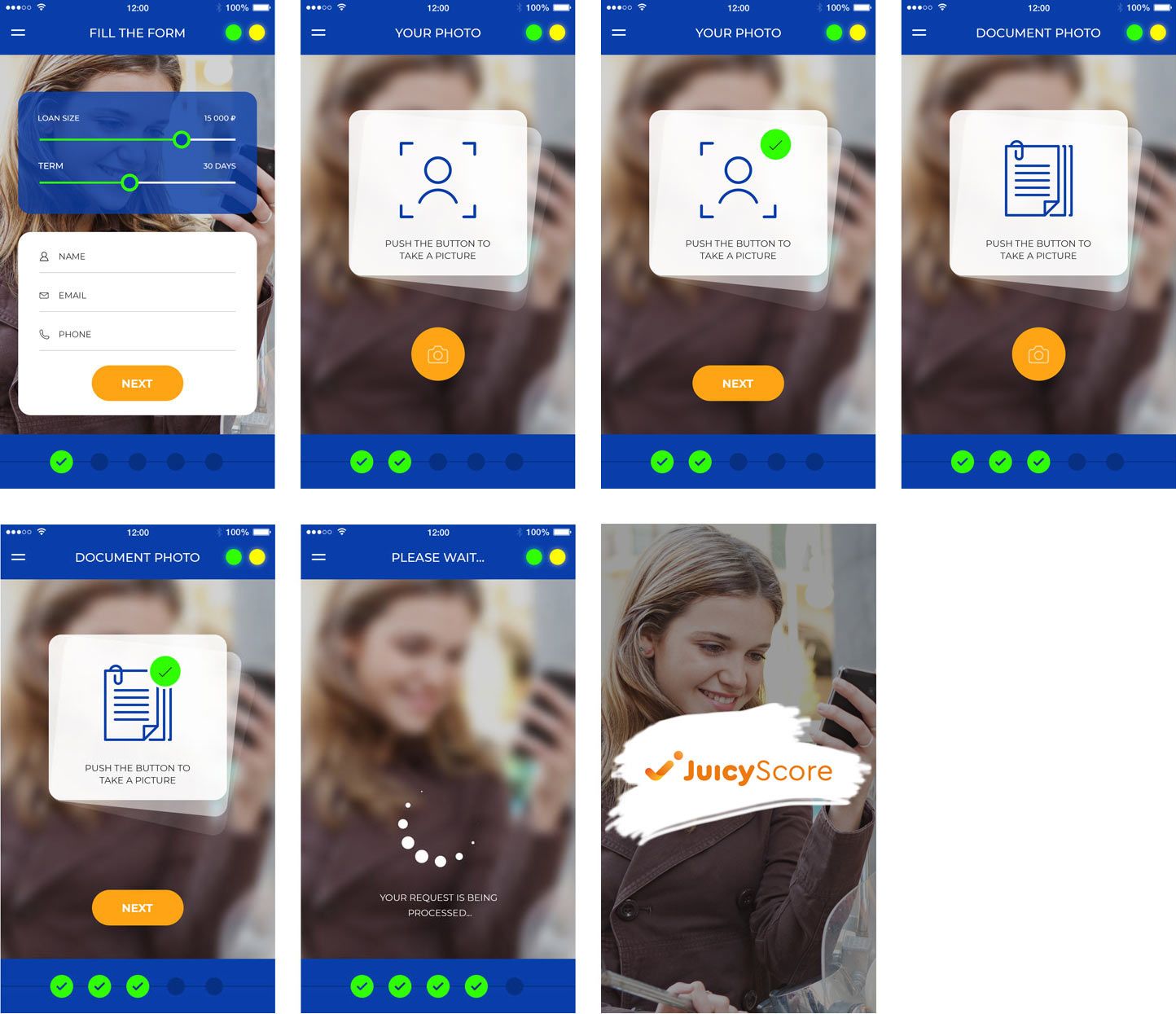

To avoid such mistakes, as well as to call additional checks only when necessary, together with partners we tried to develop our way of customer identification. The main values and principles of our approach are:

- We use stable in time identifiers;

- We do not work with the image of the client, but only collect certain and sufficient factors that describe the properties of this image;

- Information gathering takes tenths of a second, without giving sensible inconveniences to the client in the process of application fulfilment;

- We do not collect and especially do not store personal and other data that may bring a risk to the customer — data we collect can not be used for taking a loan!

Picture 2: the prototype of our application for dynamic identification

The combination of all these factors makes it possible not only to obtain high accuracy identification but also to introduce the dynamic identification when only the necessary information is requested, which helps to minimize the shades of gray in the client stream.