In February, we published an article about how the psychotype affects credit service users financial behavior. In addition to that, in June, we launched a laboratory for the evaluation of non-personal data — psychotype.online . Today we turn back again to the topic of the psychotype influence on the borrower’s credit behavior and income assessment. Referring to our research, we will talk about various data types synergy to gather more information about the client.

There is no secret that “standard” documents and data (for example income tax certificate, also known as 2-NDFL), are not always efficient factors for a client’s rating, since in many cases it is difficult to confirm or deny the indicated information.

To make a decision on loan, it is extremely important to know the disposable income of the client. However, any information about the finances and income of a particular person is extremely sensitive. People do not like to discuss it. Moreover, It will also be uncomfortable to answer, in case a prospect client is asked online about his or her income rate. In addition to that, such questions may discourage the client in service use. According to our estimates: about 50% of clients do not answer question about their income and at least 15% of those who answered — manipulate with numbers.

Although the level of income is not personal data, it is extremely sensitive information for the client. However, within the existing credit decision approach, credit organizations still either use a little or even ignore alternative data. That is why focused to develop a model that does not use consumer personal or other sensitive information.

This model can be built on device quality data and Internet-connection characteristics. In addition, if we also add psychological characteristics of a person and use the results of our research on the correlation between disposable income and temper, you can get a very powerful tool with high precision.

User behavior markers may rate the device characteristics, loan applications frequency, and connection quality. Temper completes the picture, which results in an impersonal user portrait with all necessary data in it. The device quality rate (minimum value is zero, maximum is 5), together with other predictors, which have already demonstrated a high predictive power.

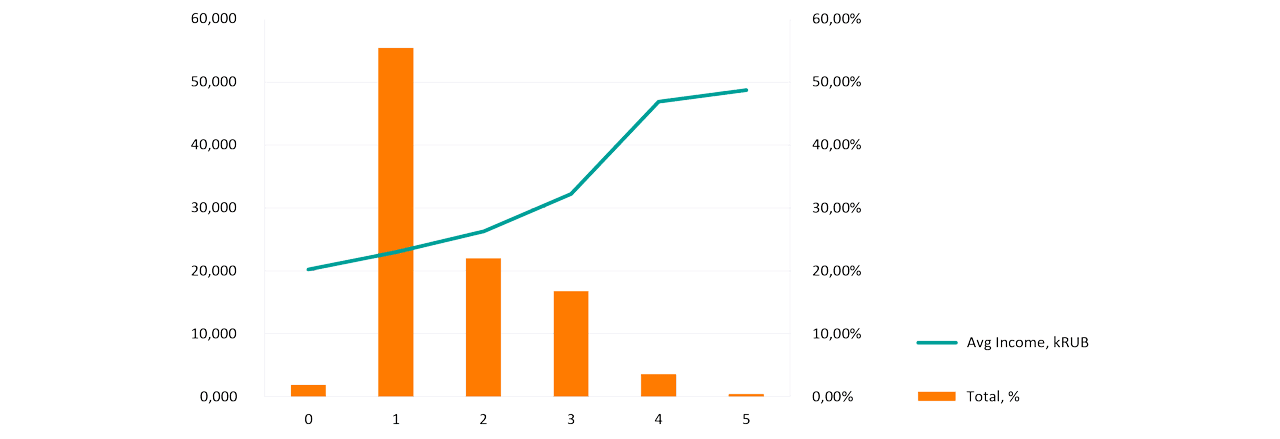

Graph 1. Device quality index and disposable income (in thousand rubles)

As can be seen from the graph, most of the borrowers use inexpensive devices. In addition, the population total disposable income may be determined for the country or region where this data has been collected. The owners of higher-quality gadgets were distributed in the fourth and fifth groups, where the income level is pretty much big. But what if the relationship between the device quality and an average income is insufficiently indicative?

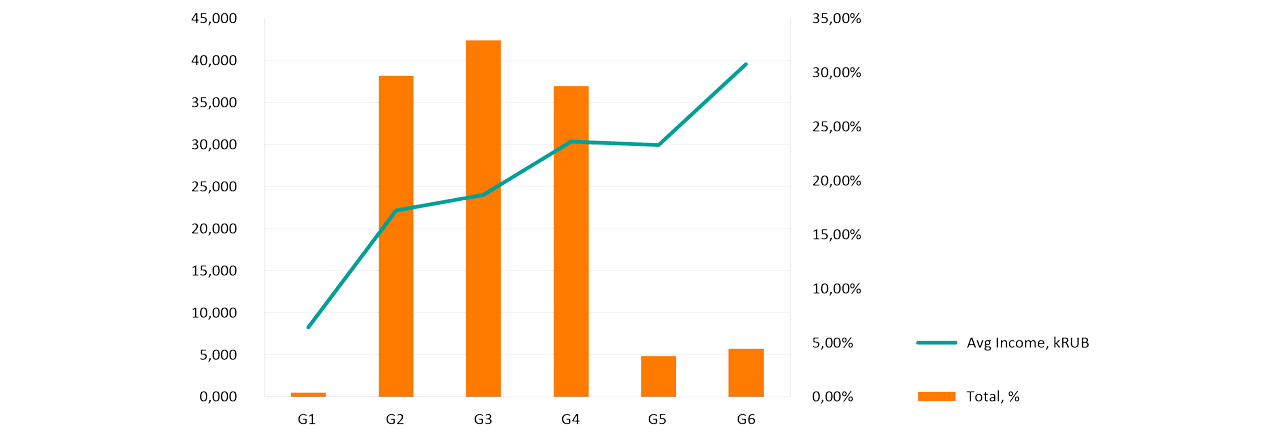

Let us look at the variable that characterizes the quality of the Internet infrastructure. From Graph 2 it follows that the infrastructure quality index can also say a lot about the client’s disposable income.

Graph 2. Categories of infrastructure quality index and disposable income (in thousand rubles)

The higher the value of the infrastructure quality index (distributed from G1 to G6), the higher the disposable income of the applicant.

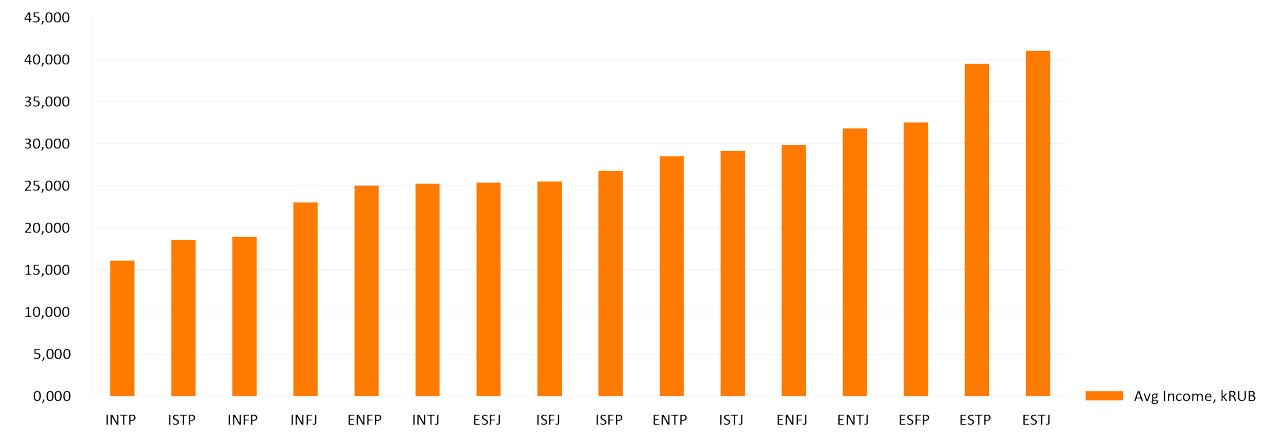

Now let us see how a person’s income depends on his psychological type. If you look at Graph 3, it immediately is clearly identified that Extroverts (the first letter E designates the type) according to statistics have much higher income level than Introverts (the first letter I designates the type).

Graph 3. The distribution of disposable income (in thousand rubles) by psychological types

This can be explained by the fact that people with a bold, strong-willed temper often become leaders and occupy executive roles, respectively, have a higher salary level. Another fundamental property of the individual is how a person prefers to perceive information — in general or detail-focused. A similar dependence is seen in connection between temper and device quality index.

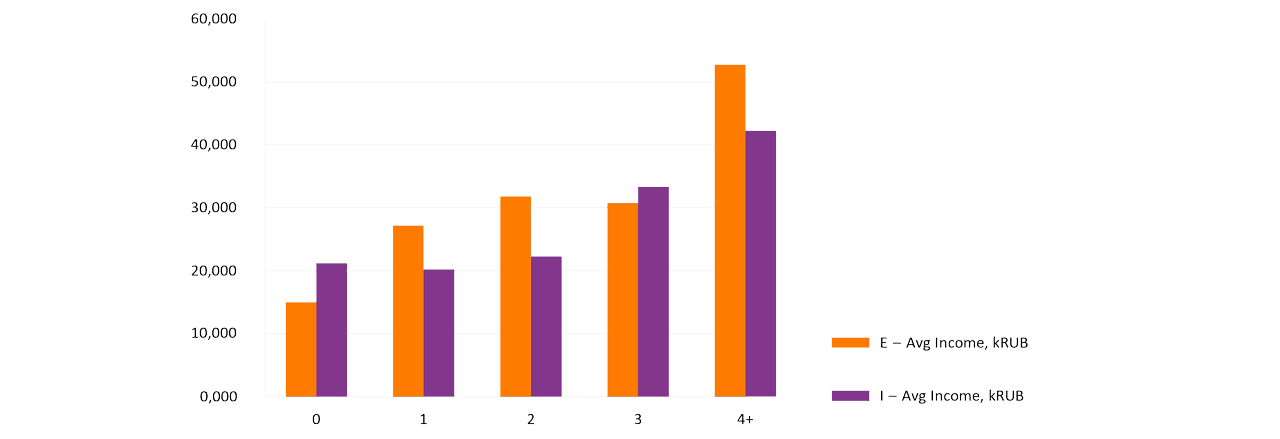

Graph 4. Distribution of disposable income (in thousand rubles) among extroverts and introverts according to the device quality index

Even if an introvert and an extrovert use a device with the same quality rate, they may have different average income.

Therefore, it can be concluded that the model, which accounts the client’s psychological type, has greater predictive power and accuracy.

Research shows that financial activity, credit services usage frequency, amount and characteristics of a client’s cash flow directly depend on temper. We have collected data available in the current version of the API, and enriched them with information on psychotypes — this is how a simple model for disposable-income determination appeared. It includes 5–10 variables, and the received R2 level is significantly higher than 0.7, which indicates its high level of stability.

The model demonstrates the effective use of alternative data to determine disposable income — the most important factor in credit decision-making. Moreover, it operates without personal data and requests from the client sensitive information.