Despite a slight slowdown in microfinance sector during the pandemic period some experts prognosticate the rapid growth of microfinancial industry in the next 5 years due to the rise and implementation of advanced technologies. In our new article we are going to tell you about the latest business model approaches that can be powerful instruments in the way of evolutionary growth of microfinance organizations and neobanks in a constantly changing and challenging environment.

International microfinance sector development experience shows that setting interest rate limits on loan products is an inevitable process and financial institutions that can successfully adapt to such conditions have an opportunity for sustainable growth. In addition, these financial institutions can rely on strong customer support and loyalty, which improve the image of the companies in the opinion of regulators as well. The experience of such countries as China, Great Britain, Spain, Poland and Latvia that managed to implement the principle of "create first, regulate later" shows that this is the only possible way, while the restrictive government policy regarding fintech industry leads to significant growth of the gray market and to a lack of transparent regulation and consumer protection.

Basing on our experience and work in 17+ countries JuicyScore experts believe that the following business model development scenarios are worth to be taken into consideration by fintech companies:

- Changing user acquisition model and reducing lead generation cost;

- Gradual transition from PDL to Installment (IL) model by increasing the average duration and average size of the loan from 15-30 to 45-60 + days;

- Reducing the cost of risk through investments in risk assessment technology, new data and increasing the proportion of loans provided with mobile applications;

- Development of online POS lending based on the installment plan / online loan model;

- Applying of microfinance organizations to a pawn shop transformation model, development of a pawn mechanism in the lending system based on the pawn of a personal mobile device, vehicle and/or other available assets of the borrower;

- Development of partnership with banks and large financial institutions in order to work with the “rejected” flow of applications;

- Optimization of OPEX to reduce the cost of new customer acquisition and customer service.

In this article we are going to take a closer look to the above mentioned scenarios which may help to adapt to the decreasing rate conditions and find your way to a sustainable business model.

Changing customer acquisition model and reducing lead generation cost.

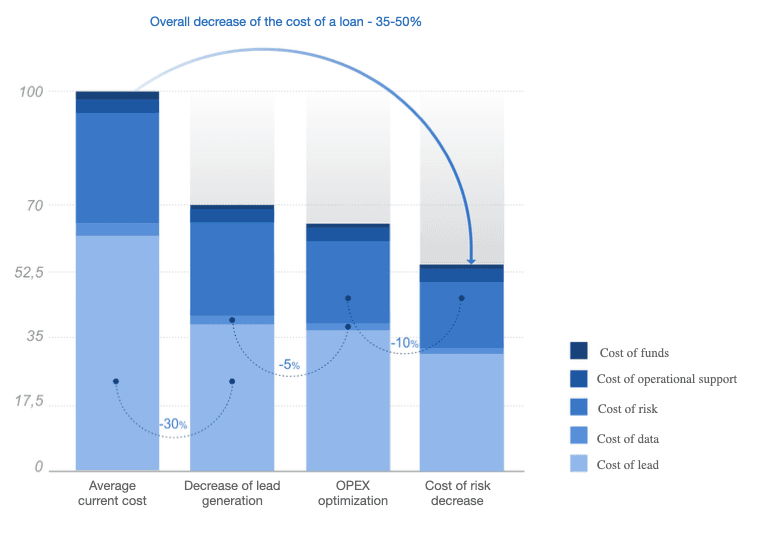

The structure of the loan cost can be represented as a combination of five components: cost of lead, cost of data, cost of risk, cost of operational support and cost of funds (Chart 1).

As you can see on the chart consistent work with each cost will lead to an overall decrease in the cost of a loan by 1.5-2 times.

The left column (Max) shows the peak values. As you can see, a significant share is the cost of lead (there are some cases when the cost of lead is 60-70% of the cost of a loan). The middle column (Average) is an intermediate stage between the current and potential target. Reducing the cost of these components (all of the them or at least some significant part) will allow to shift to a model with a target cost level (Min) gradually.

The main part of the cost of a loan is the cost of lead, so the most tangible and significant result may be achieved by reducing this particular component. The emerging trend of regulation (and, as a matter of fact, limitation) of lending rates will bring pressure to bear on lenders as well as on their efforts to reduce the cost of customer acquisition. Reducing the cost of acquisition by increasing the share of natural traffic, extensive use of low-frequency contextual keys, media partnerships, etc. is an important step towards the target cost model.

Transition from PDL to Installment (IL) model by increasing the average duration and average size of the loan.

Rate regulation and reduction may be rather painful for any microfinance organization. On the one hand, rate reduction increases the availability of borrowed funds, on the other hand, it reduces the target audience in those segments where such rates cannot cover the level of risk. The main challenge of the market is finding a balance between the rate and the level of availability of borrowed funds.

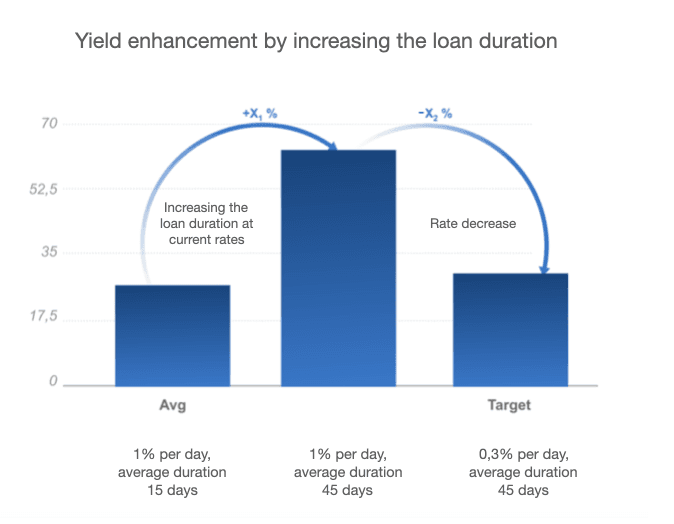

Chart 2 shows an example of yield enhancement scenario by increasing the loan duration.

Reducing the cost of risk through investments in risk assessment technology, new data and increasing the proportion of loans provided with mobile applications.

Last November we conducted a survey among our clients, who are the top performers in microfinance market all over the globe. According to the results of our research, the main categories for data market turned to be the balance of information content and payback as well as compliance with current and prospective regulation rules, especially taking into consideration the trends and changes we observed within the last 2-3 years (i.e. requirement strengthening in the Russian Federation regulations, a project regulations similar to GDPR in China etc.). Therefore, data data payback and maintaining the balance between the cost and data informativeness will play an increasingly important role and become an important step in reducing of the cost of a loan.

Risk reduction can be achieved by improving the methods for risk assessment, including the development of a technology stack, dynamic authentication, processing of all data sources available on the market in order to increase information value, quality and speed of decision-making. Increasing the proportion of loans provided with mobile applications will also reduce the level of risk for it will also increase the amount of data available for risk assessment.

Chart 3 shows a general approach to the cost reduction of the components described above and to the loan cost optimization. As you can see the transition from one product model to another will allow to stabilize the yield of the loan in absolute terms in the context of gradual decrease of the maximum interest rate.

Development of online POS lending based on the installment plan / online loan model.

POS lending is one of the fastest growing segments of the microfinance market. Online trading turnover has grown significantly: according to the Retail Companies Association (ACORT), the impact of the pandemic will accelerate the growth of e-commerce in Russia by 6% per year until 2024. Thus, "going online" spurred the growth, which was restrained by the decline in real income during the quarantine and the subsequent restrictive measures. Development of online-POS lending with a relatively low-risk audience and cooperation with retail will become one of the growth drivers in microfinance and neobanking sectors.

Applying of microfinance organizations to a pawn shop transformation model, development of a pawn mechanism in the lending system.

One of the effective tools that will reduce risks by means of the assessment of the collateral as well as maintain the interest income at the same level while reducing the burden on the borrower, is applying of microfinance organizations to a pawn shop transformation model. The collateral is a certain guarantee of debt repayment, depending on the category of collateral (its value and liquidity), the risk assessment may change, which makes it possible to implement a flexible approach to the range of credit products offered.

Development of partnership with banks in order to work with the “rejected” flow of applications.

Speaking about borrower selection, banks have more strict and rigorous approach and this trend has increased lately. In 2018 about 41% of loans in the Russian Federation were approved. In the end of the last year the share of approved applications dropped below minimum, reaching 32.2%. Experts are attributing this this to the measures taken by the Bank of Russia against the growth of household debt load as well as decline in borrowers' income. This situation offers great promise for cooperation between banks and microfinance organizations in order to work with the “rejected” flow of bank clients' applications. Development of this cooperation will allow microfinance organizations to get access to better traffic, because the segment of potential bank borrowers usually has better payment discipline and borrowing capacity. Access to the rejected flow of large financial institutions will reduce the cost of acquisition and lead generation.

Optimization of OPEX to reduce the cost of new customer acquisition and customer service.

Operational expenses that are not related to the cost of the data still remain an important field for the loan cost optimization. By such expenses we mean the entire cycle of operations occurring within the organization for getting a client, maintaining all the documentation, accounts, payments, as well as a call center and collection of debts. Reducing the OPEX for case management often requires many changes in the way organization operates as well as an increase in the internal efficiency. Among such measures can be a transfer of a significant part of transactions from offline to online, reduction of the number of required documents for obtaining a loan, usage of various technologies to reduce the burden on call centers, optimization the debt collection costs etc.

The year 2020 brought many challenges, but we can't but agree that even in this difficult period microfinance organizations shoulder the burden of a very important function of developing a new model of online lending stepping aside of the classical banking model. Microloans have their own position in the financial services market and microfinance organizations have become a significant institution that is capable of solving many social and economic problems. The microfinance sector deals with an important problem of financial inclusion that has become a genuine concern in the recent years. Microfinance organizations are sometimes the only alternative to traditional lending. According to creditsummit.com, about 65% of the world's microcredit consumers live in rural areas where there are no banks or ATMs, while less than 20% of borrowers from developing countries received loans using traditional financial instruments. High competition among microfinance organizations, openness to further innovations will allow them to increase their market share and to defy competition with traditional banks.