Last year Russia showed unprecedented speed of credit obligations growth. The total outstanding balance for all types of loans reached 14.9 trillion rubles. The speed of lending growth is still high which leads to new challenges for risk management. Debt refinance and consolidation programs offered by financial institutions and regulator’s actions aimed to control the debt burden are the evidence of general concern.

Our today’s article will be about the debt burden, its estimation difficulties and how alternative data can help in the calculations.

- Debt burden is the outstanding balance on all credit accounts. For a borrower, it is essential that this amount corresponds with his or her income. To measure this correspondence, debt-to-income ratio is used, commonly defined as DTI or PTI (payment to income)*. Basically, it reflects how much debt the borrower can handle.

As experience shows, the conventional “normal” PTI ratio would be between 0.30 and 0.50. At this range, the debtor would be able to cover a loan evenly, without cutting too much on the everyday spending. At the point of 0.50 and over, most conservative financial institutions would offer the loan at less desirable conditions or even reject it. The closer to 1, the higher the risks of both giving an irrecoverable loan and also pushing the borrower to bankruptcy. The whole burden of responsibility may then lie on the lender that has incorrectly calculated or evaluated the PTI ratio.

Some recent problems about PTI calculation

Let’s say, there is a client who has applied for a loan and needs to provide information on his income.

The primal thing to do would be providing an income tax certificate, also known as 2-NDFL (or another standard document on the list). We have discussed though some peculiarities of the information indicated there: it can be insufficient or inaccurate. For a client who has obtained a loan before, it may be possible to calculate the new level of income taking into account some public data (e.g. adjusted to the official inflation rate). A payroll customer’s income is the most transparent, yet by far not every loan provider boasts a big portfolio of payroll customers.

If it is not possible to estimate the disposable income (for example, if the borrower is self-employed), it will be more difficult to make a decision which may even result in rejection. This would be an undesirable outcome for business yet this is what we currently see in practice.

Let’s consider the second element, which is the debt burden. There are some exceptional cases here, too.

The main source of such information on a borrower for now is the credit history that shows all current and closed credit obligations, as well as payment discipline. Credit history is the most reliable argument in decision making; the problem is that the information is updated within 5 working days. With his back to the wall, a client may overgrow with quick loans and debts, and the corresponding information may not only hold off, but it may stay behind at all. The consequences of such a burden will not be long in coming. The same effect may have social ways of raising one’s loan burden, such as borrowing from neighbours or friends. Information about such loans will never reach any informing or regulating institutions, yet the total loan burden will rise dramatically.

If we look at the credit bureau statistics, debt burden rate is one of the key factors for credit delinquency, even if the client has never violated his payment discipline before.

What do we have on the whole?

There we have a client whose income may consist of declared salary, which is easily verified, and of undeclared and unstable payments as well. It is partially spent to cover regular or unforeseen daily costs. The debt burden may include both transparent legal loans and money borrowed on trust.

As a result, PTI calculation looks like an equation with two unpredictable unknowns, whereby calculating PTI is not only a need, but also a must for a financial organisation, and the regulator is getting more and more concerned about this factor

This is what we have as a problem when we come to estimate and calculate a client’s PTI:

- There is still no reliable information on the borrower’s income;

- The information on the loan burden may be irrelevant or incomplete;

- Due to the lack of 100% reliable data, the tool is far from perfect, while all the risks related to the decision will lie with the lender.

What are the possible solutions?

We suppose that alternative data may be used in addition to the conventional information sources. It will help to estimate the client’s income and debt burden indirectly, and reconfirm the estimate given by traditional sources such as credit bureau. Working with alternative data, we offer a solution that allows making up for the lacked information and raise the value of the debt burden estimation.

We can tell more about the client’s income upon:

- Internet infrastructure quality evaluation that was used to send the loan application. The higher the quality, the higher the income, and vice versa. Therefore, if it is an infrastructure of a higher quality, the risk that the credit may turn out irrecoverable or paid with delinquency will be lower.

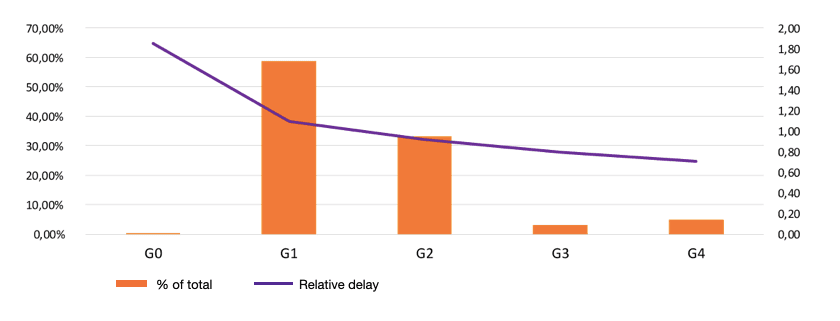

Graph 1. Relative quality evaluation of an Internet infrastructure (from G0 to G4) compared to a relative delinquency

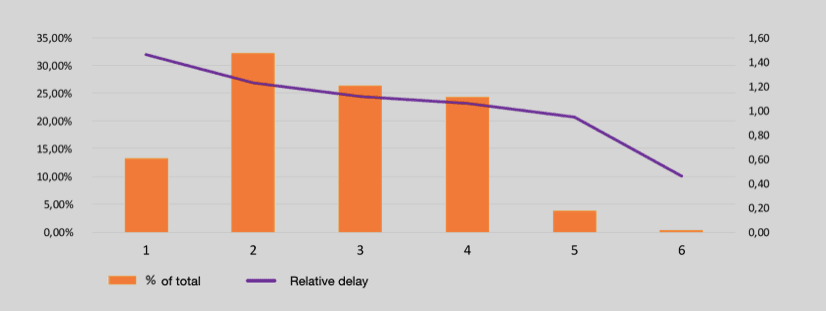

- Device quality evaluation that was used to send the application. Hardware quality, device year of issue and other parameters can be put together, which will give a rather high correlation with the income. If you add the period of time since the device has been associated with the user and his behavioural data, the reliability of this evaluation will be significantly higher (R2-level over 75%).

Graph 2. Relative quality evaluation of the device (from 0 to 5) compared to a relative delinquency

We can also fill gaps in the information distributed to the lender due to:

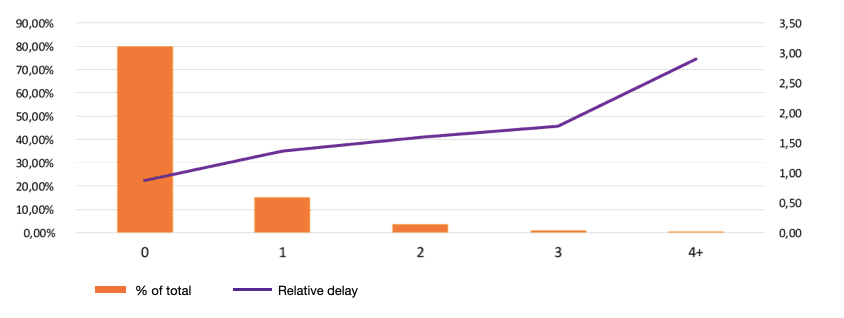

- Analysing loan applications frequency from the device and virtual ID that indicates the applicant’s need in a loan and recently opened credit obligations. The higher the applicant’s short-period demand for credit or loans, the higher the risk.

Graph 3. Relative delinquency depending on the number of loan applications during one week for a random user

- Cooperation with 80% of microlenders, credit unions and pawnshops on the market, which adds to the data on loan applications and improves the accuracy of the borrower’s risk estimate.

In combining this information with conventional evidences of income and outcome, it is possible to improve the accuracy of PTI estimate, making financial organisations safe from potentially irrecoverable debts and risk regulators, also preventing borrowers from excessive debts.

Your Juicy Team

* We prefer the international term “PTI” counting the borrower’s monthly loan payment in regard to the monthly income (a more conservative estimate is often used, when the income is calculated net of indispensable and essential costs). These terms are frequently used as synonyms, in reference to the PTI’s meaning, because debt-to-income ratio takes the total amount of the borrower’s loan obligations into account and is not so demonstrative, especially when the borrower has an open long-term loan of a large amount of money (such as car loan or mortgage loan).